Schwab Managed Portfolios: Asset Allocation

Schwab Managed Portfolios – Mutual Funds

With Schwab Managed Portfolios™ - Mutual Funds you'll discover a convenient yet sophisticated way to get the diversification you need. Each portfolio is managed for you by the investment professionals at Schwab Asset Management™.

Compare Mutual Fund Portfolios

Asset allocation strategies we might recommend.

-

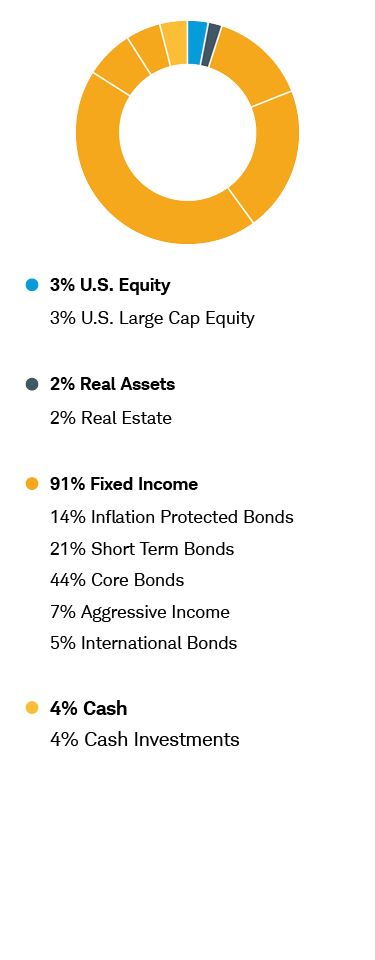

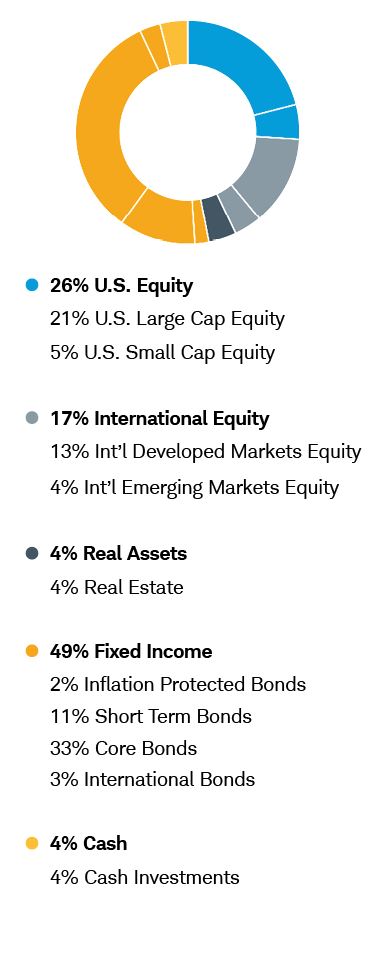

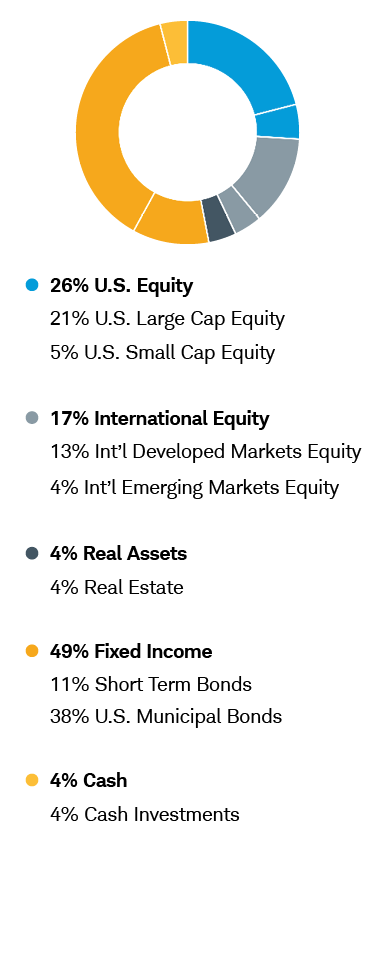

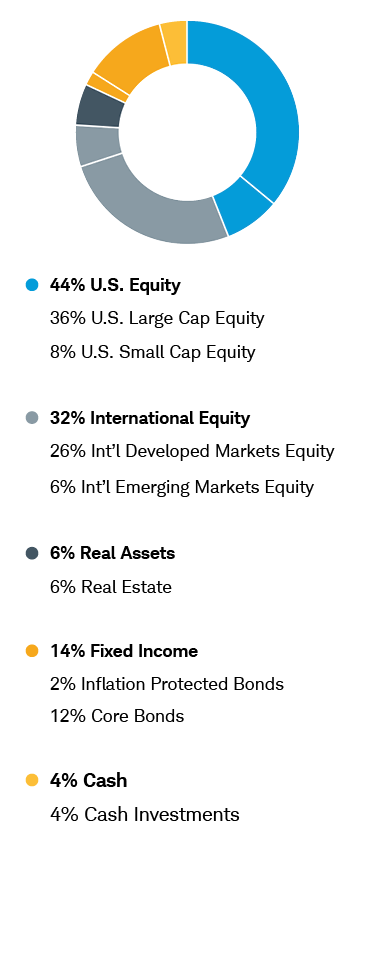

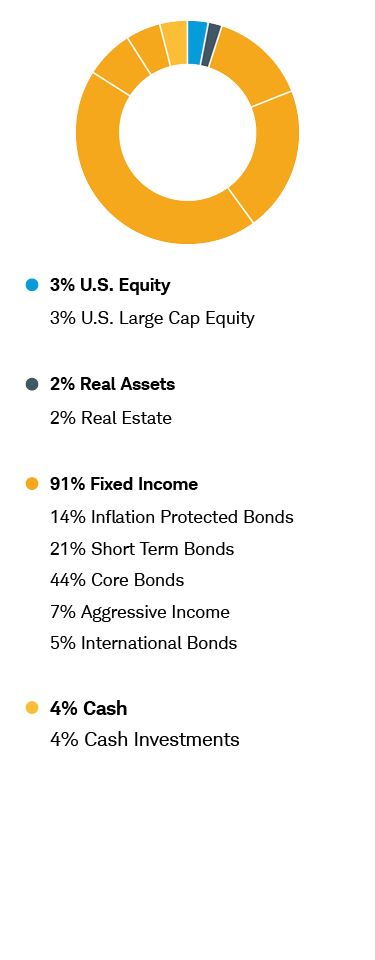

Conservative Income

-

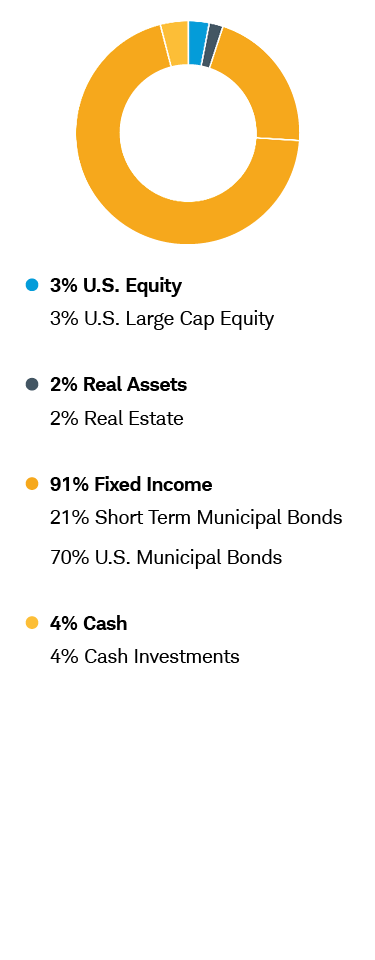

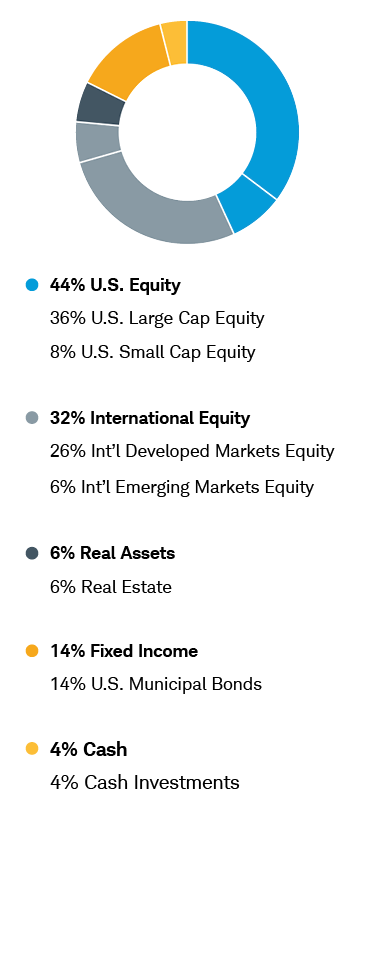

Conservative Income–Tax Aware

-

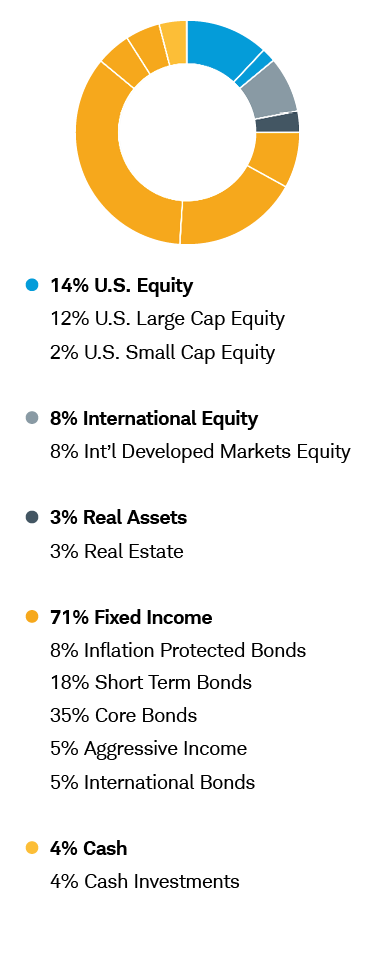

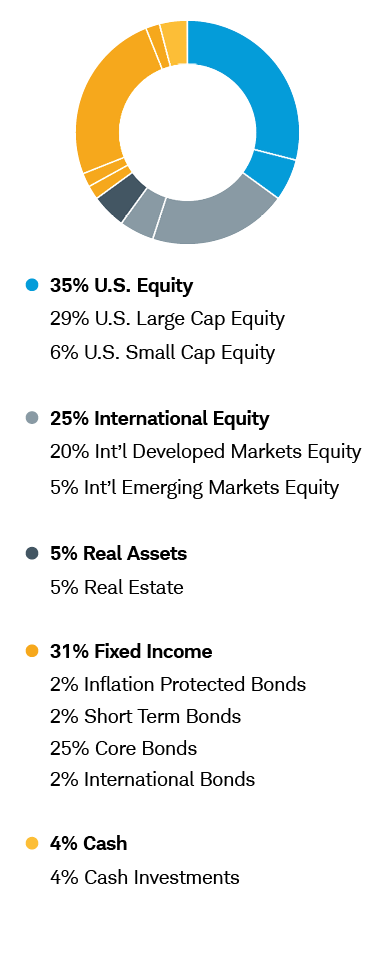

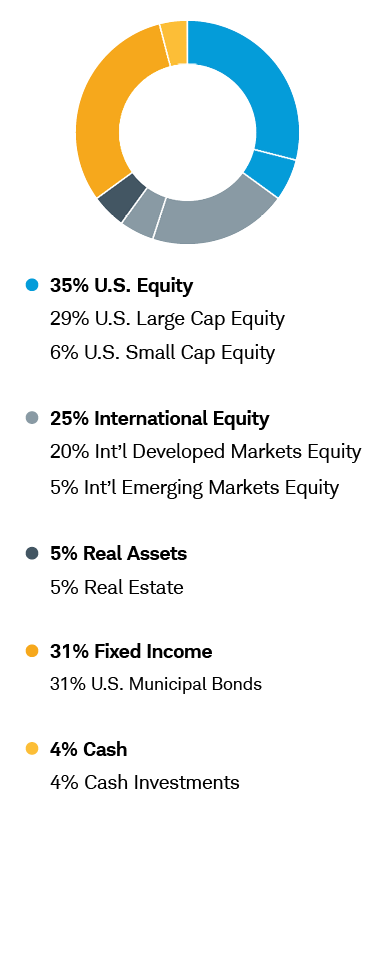

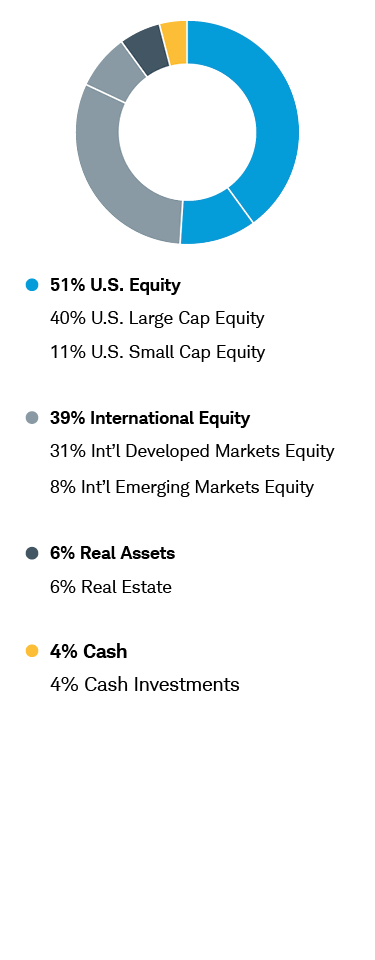

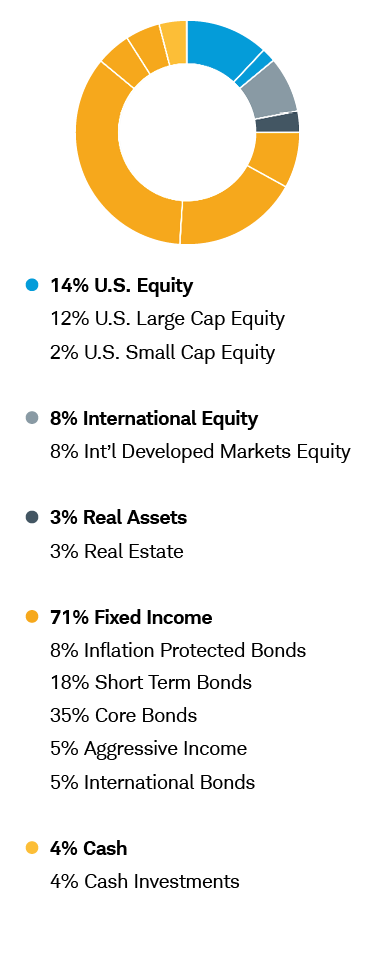

Income with Growth

-

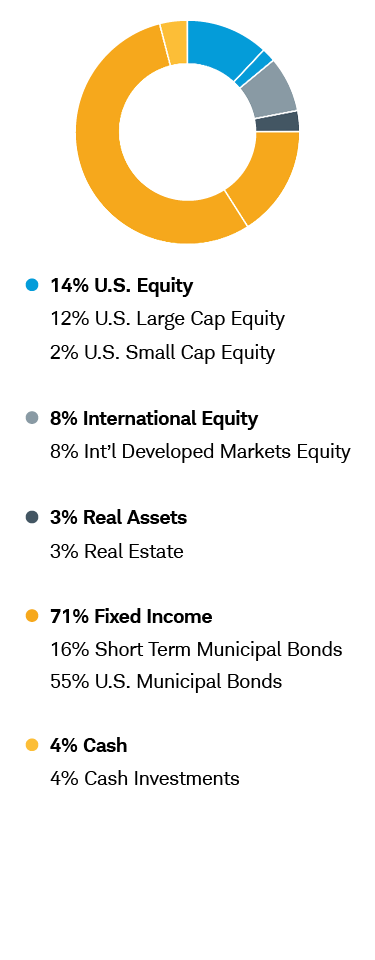

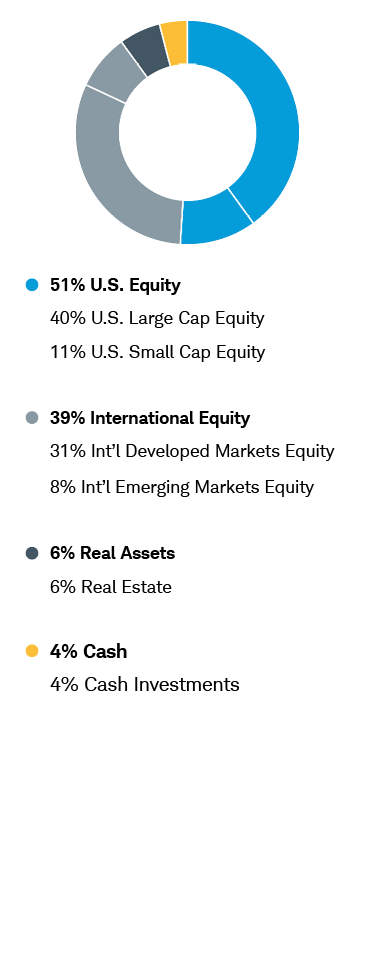

Income with Growth–Tax Aware

-

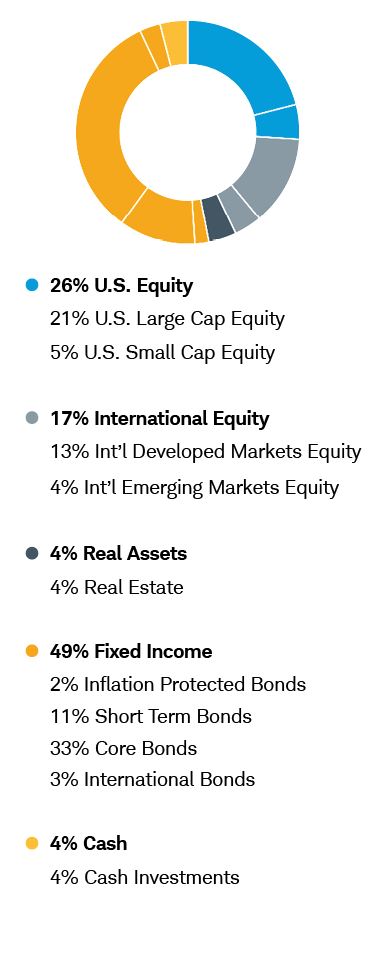

Balanced

-

Balanced–Tax Aware

-

Allocations are effective as of 4/1/2023. Underlying weightings will adjust per market conditions, and actual account holdings may vary.

Asset allocation strategies we might recommend.

-

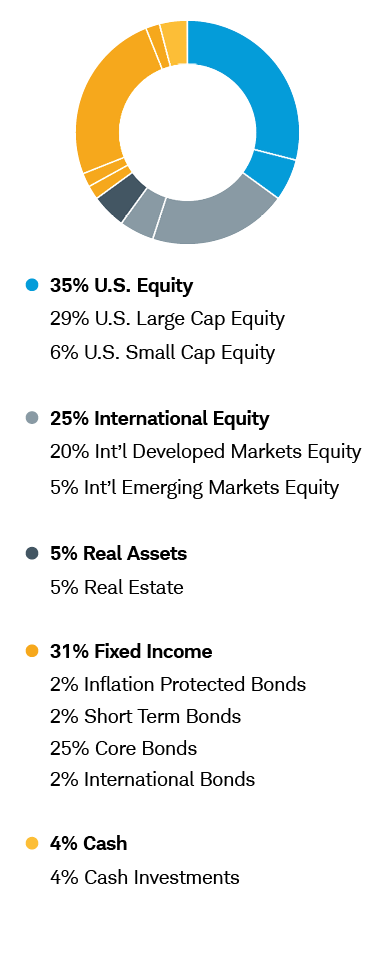

Balanced with Growth

-

Balanced with Growth–Tax Aware

-

Growth

-

Growth–Tax Aware

-

Aggressive Growth

-

Aggressive Growth–Tax Aware

-

Allocations are effective as of 4/1/2023. Underlying weightings will adjust per market conditions, and actual account holdings may vary.

Schwab Managed Portfolios – ETFs

Schwab Managed Portfolios™ – ETFs offer broadly diversified, professionally managed portfolios of ETFs designed to match your investment strategy and tolerance for risk. Each ETF portfolio is managed for you by the investment professionals at Schwab Asset Management.

Compare ETF Portfolios

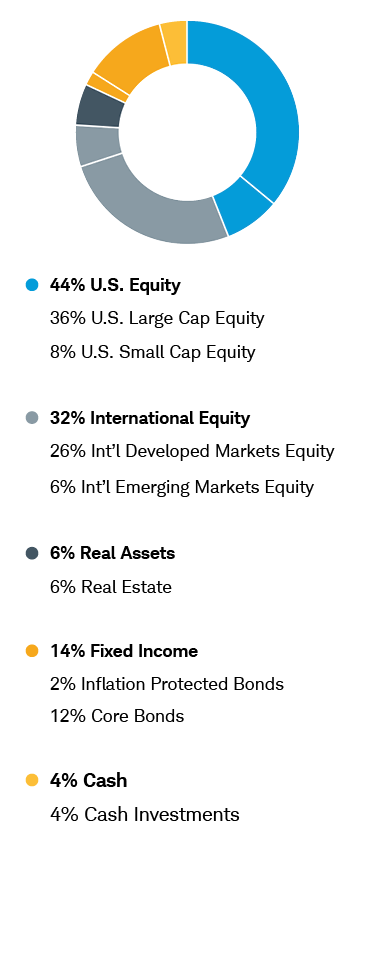

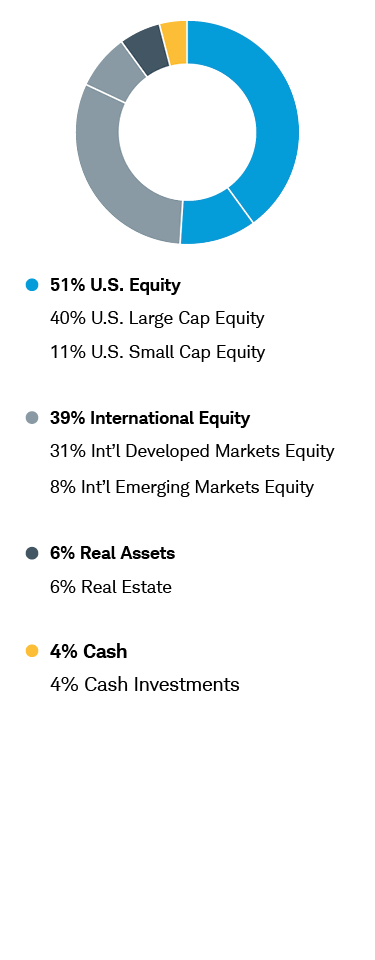

Asset allocation strategies we might recommend.

-

Conservative Income

-

Income with Growth

-

Balanced

-

Balanced with Growth

-

Growth

-

Aggressive Growth

-

Allocations are effective as of 4/1/2023. Underlying weightings will adjust per market conditions, and actual account holdings may vary.

Questions? We're ready to help.

-

Call

Call -

Chat

Chat -

.jpg) Visit

Visit