What Should Your Retirement Portfolio Include?

As exciting as the prospect of retirement is, it can also feel daunting. Not only do you have to start living off your savings, but you also need to make sure you don't run out of money. So, how do you build a retirement portfolio that serves both purposes?

"It's all about striking the right balance between preservation and growth," says Rob Williams, managing director of financial planning, retirement income, and wealth management at the Schwab Center for Financial Research. "After all, when you need your savings to last 30 years or more, being too conservative too soon can put your portfolio's longevity at risk."

With that in mind, here are three tips for creating a retirement portfolio that's more likely to go the distance.

1. Protect your downside

Making a big withdrawal from your retirement savings in the midst of a downturn can have a negative impact on your portfolio over the long-term. To help protect against that possibility, it's a good idea to add two safety nets to your retirement portfolio:

- A year's worth of spending cash: At the start of every year, make sure you have enough cash on hand to supplement your regular annual income from annuities, pensions, Social Security, rental, and other regular income. Hold the money in a relatively safe, liquid account, such as an interest-bearing bank account or money market fund.

- Two to four years' worth of living expenses: From the 1960s through 2021, the average peak-to-peak recovery time for a diversified index of stocks in bear markets was roughly three and a half years.1 So, it's wise to keep two to four years' worth of living expenses in short-term bonds, certificates of deposit (CD), or other reasonably liquid accounts. This way, you'll have access to cash during a downturn if you need it, without selling stocks.

2. Balance income and growth

Once you have your short-term reserves in place, it's time to allocate the remainder of your portfolio to investments that align with your goals, time horizon, and risk tolerance. Ideally, you'll choose a mix of stocks, bonds, and cash investments that will work together to generate a steady stream of retirement income and future growth—all while helping to preserve your money. For example, you could:

- Build a bond ladder: Purchasing bonds with staggered coupon and maturity dates can help even out your portfolio's yields over time and provide a steady flow of income.

- Opt for dividend-payers: Consider adding some dividend-paying stocks to your portfolio. Not only do they offer a regular stream of income, but they also allow your principal to remain invested for potential growth.

- Stick with stocks: Make sure you don't dial back your exposure to stocks too soon. Having a larger allocation of stocks in the early years of retirement will help guard against the risk of outliving your retirement savings. Later on, you can adjust your allocation to focus more on generating income and preserving your money.

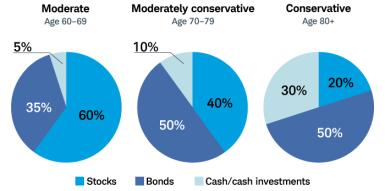

Shifting your strategy

Investors in the early years of retirement may want a greater allocation to stocks to guard against longevity risk, while those in their later years will want to prioritize income generation and capital preservation.

At age 60–69, consider a moderate portfolio (60% stock, 35% bonds, 5% cash/cash investments); 70–79, moderately conservative (40% stock, 50% bonds, 10% cash/cash investments); 80 and above, conservative (20% stock, 50% bonds, 30% cash/cash investments).

This example is hypothetical and provided for illustrative purposes only.

3. Consider all your income sources

As you put together your retirement portfolio, you also need to think about the role your savings will play in your overall income plan. For example, how much income do you expect from guaranteed sources like annuities, pensions, and Social Security?

"If these guaranteed income streams will generate enough income to cover the majority of your expenses, you might be able to maintain a more aggressive stance with your portfolio well into retirement," Rob says. "Conversely, if you'll rely on your portfolio for the majority of your income, you'll need to take a more balanced approach with your investments."

-

Learn more about retirement income

-

How to plan your retirement withdrawals