The Benefits of Diversification: Asset Classes Included in Schwab Intelligent Portfolios

Key Points

- Long-term, strategic asset allocation and diversification is the basis of the Schwab Intelligent Portfolios® investment strategy.

- All else equal, diversification lowers portfolio risk and can lead to higher wealth in the long run.

- Schwab Intelligent Portfolios invests in a broad range of asset classes, each of which serves a unique role and purpose in a diversified portfolio.

Introduction

Asset allocation—dividing an investment portfolio into different asset classes, such as stocks, bonds, commodities, and cash investments —has been the cornerstone of portfolio construction for decades. The goal of asset allocation is to reduce risk through diversification by combining exposures to a variety of investments that have historically performed differently during various market conditions.

This paper provides a brief overview of diversification and explains the asset classes and investment strategies offered in Schwab Intelligent Portfolios.

Diversification: "the only free lunch in finance"

Nobel Prize-winning economist Harry Markowitz once called diversification "the only free lunch in finance," and this well-known concept forms the basis of our investment strategy. Diversification makes intuitive sense—when one asset class suffers, it pays to not have all your eggs in one basket. Mathematically, diversification is made possible by the fact that individual assets typically aren't perfectly correlated. In other words, if asset values do not move up and down in perfect harmony, then a diversified portfolio will have less risk than the weighted average risk of its constituent parts.

The benefits of diversification

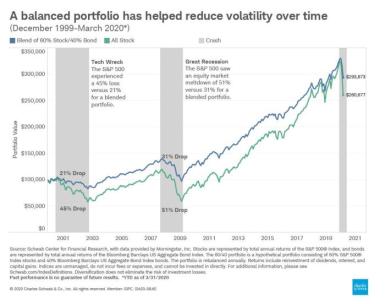

The example below looks at the historical performance of $100,000 invested in a 100% stock portfolio compared to a 60% stock, 40% bond portfolio over the 20 year period from December 1999 to March 2020. Interestingly, a 60/40 portfolio slightly outperformed an all stock portfolio and did so with meaningfully less volatility as seen by the reduced drawdown during the so-called "tech bubble" in 2002, the great recession in 2009, and the COVID-19 global pandemic in March 2020. This example demonstrates the benefit that asset allocation and diversification can offer: better risk-adjusted returns. This can be advantageous when growing wealth over time. It's not immediately obvious, but the reason lower portfolio risk can lead to higher wealth in the long run is that a portfolio with lower risk generally does not decline as much in a market downturn, so it has less ground to recover to get back to breakeven compared to a portfolio that saw a larger decline. For example, a portfolio that falls in value by 50% must grow by 100% to recover from its loss; a portfolio that declines by 10% only needs to grow by 11% to recover.

Exhibit 1: Historical performance of $100,000 investment: 1999-2019

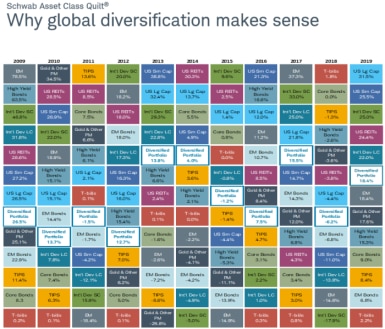

The benefits of diversification can also be visualized using the quilt chart below which ranks (top to bottom) the annual performance of various asset classes from 2010 to 2019. For example, cash investments, as measured by Treasury bills, were the best performing asset class in 2018, but subsequently, the worst-performing asset class in 2019. By contrast, international stocks were the worst-performing asset class in 2018, but they had been among the best-performing in 2017. Such charts highlight the stark changes in asset class performance year-to-year, not to mention the difficulty in predicting which asset class will be at the top. Rather than trying to forecast performance, investing in a diversified portfolio across asset classes helps to ensure that at any given time the portfolio will hold some of the top performers while not being overly concentrated in the bottom performers as they shift from year to year.

Exhibit 2: Annual performance of various asset classes: 2009-2019

Source: Morningstar Direct. Data is from January 1, 2009- December 31, 2019. This chart represents a hypothetical investment and is for illustrative purposes only. Diversification strategies do not ensure a profit and do not protect against losses in declining markets. Past performance is no indication of future results. See Full Disclosure of chart and indices in the back of the document under Important Information.

Asset classes included in Schwab Intelligent Portfolios

We were deliberate and thoughtful when choosing the asset classes to include in Schwab Intelligent Portfolios. Selected investments should provide unique risk or return characteristics and be as minimally correlated as possible in order to take advantage of the benefits of diversification. Said differently, Schwab Intelligent Portfolios invests in a variety of U.S. and international asset classes to diversify each portfolio's sources of risk and return, whether that is from domestic or international corporate earnings, interest rates, inflation, or currencies. The table below shows the 20 expanded asset classes available in Schwab Intelligent Portfolios.

Exhibit 3: Schwab Intelligent Portfolios expanded asset classes and definitions

| Stocks | Description |

| U.S. Large Company Stocks | Large company stocks—or "large caps"—are investments in the equity of larger U.S. companies, generally those with more than $10 billion in market capitalization, such as Exxon Mobil Corporation or Microsoft Corporation. |

| U.S. Large Company Stocks–Fundamental | U.S. large company stocks—fundamental are investments of larger U.S. companies that are included in fundamental indexes, which screen and weight companies based on fundamental factors such as sales, cash flow and dividends. |

| U.S. Small Company Stocks | U.S. small company stocks—or "small caps"—are investments in the equity of smaller U.S. companies, generally those that represent the bottom 10% of the market by cumulative market capitalization. |

| U.S. Small Company Stocks–Fundamental | U.S. small company stocks—fundamental are investments in the equity of smaller U.S. companies that are included in fundamental indexes, which screen and weight companies based on fundamental factors such as sales, cash flow and dividends. |

| International Developed Large Company Stocks | International developed large company stocks are investments in the equity of larger foreign companies that have high market capitalizations and are based in countries with mature economies. |

| International Developed Large Company Stocks–Fundamental | International developed large company stocks – fundamental are investments in the equities of larger foreign companies that are included in fundamental indexes, which screen and weight companies based on fundamental factors such as sales, cash flow and dividends. |

| International Developed Small Company Stocks | International developed small company stocks are investments in the equity of smaller foreign companies that are based in countries with mature economies and stock markets that benefit from strong investor protections, corporate governance and legal infrastructure. |

| International Developed Small Company Stocks–Fundamental | International developed small company stocks - fundamental are investments in the equities of smaller foreign companies that are included in fundamental indexes, which screen and weight companies based on fundamental factors such as sales, cash flow and dividends. |

| International Emerging Markets Stocks | Emerging market stocks are equity investments in foreign companies domiciled in countries with developing economies that have been experiencing rapid growth and industrialization. |

| International Emerging Markets Stocks–Fundamental | International emerging market stocks—fundamental are investments in the equity of foreign companies that are based in countries experiencing rapid growth and industrialization, and are included in fundamental indexes, which screen and weight companies based on fundamental factors such as sales, cash flow and dividends. |

| U.S. Exchange-Traded REITs | U.S. exchange-traded REITs (Real Estate Investment Trusts) are investments in real estate investment trusts focused on real estate and/or mortgages or mortgage securities traded on US exchanges. REITs must pay 90% of their taxable income to shareholders every year. |

| International Exchange-Traded REITs | International exchange-traded REITs are investments in real estate investment trusts focused on real estate and/or mortgage securities traded in foreign countries. |

| U.S. High Dividend Stocks | U.S. high dividend stocks are investments in the equity of U.S. companies that tend to distribute higher-than-average dividends to shareholders. |

| International High Dividend Stocks | International high dividend stocks are investments in the equity of foreign companies that tend to distribute higher-than-average dividends. |

| Fixed Income | Description |

| U.S. Treasuries | Treasuries are debt securities of the U.S. government issued through the U.S. Department of the Treasury at various maturities, from one year or less to as long as 30 years. |

| U.S. Investment Grade Corporate Bonds | U.S. investment grade corporate bonds are investments in the debt of U.S. corporations with relatively high credit ratings provided by one or more of the major U.S. credit rating agencies. |

| U.S. Securitized Bonds | U.S. securitized bonds are securities in which principal and interest payments are backed by cash flows from a particular asset or pool of assets, such as mortgage-based securities from government agencies or government-sponsored enterprises like Ginnie Mae and Fannie Mae. |

| U.S. Inflation Protected Bonds | U.S. inflation protected bonds are securities issued by the U.S. Treasury that protect investors against inflation by adjusting the principal value based on changes in the U.S. Department of Labor's Consumer Price Index. |

| U.S. Corporate High Yield Bonds | U.S. corporate high yield bonds—sometimes known as "junk bonds"—are investments in the debt of U.S. corporations with lower credit ratings provided by the major U.S. credit rating agencies. |

| International Developed Country Bonds | International developed country bonds are debt instruments issued by a government, agency, municipality or corporation based in a highly developed country other than the U.S. International developed country government bonds typically carry investment grade credit ratings, but some may be rated below investment grade. |

| International Emerging Markets Bonds | International emerging market bonds (EM bonds) are issued by a government, agency, municipality or corporation domiciled in a developing country. |

| Preferred Securities | Preferred securities are a "hybrid" investment, sharing characteristics of both stocks and bonds. Like stocks, they are generally paid after a company's bonds in the event of a corporate liquidation. Like bonds, however, they generally make regular fixed payments and have a par value that can rise or fall as interest rates change. |

| Bank Loans | Bank loans are originated by banks and sold to institutional investors like mutual funds or ETFs. The loans are made to corporations, which use them to fund acquisitions and other strategic initiatives. The loans typically have floating rates, meaning they pay a set amount over a benchmark interest rate, often the 3-month London Interbank Offered Rate (Libor). |

| Investment Grade Municipal Bonds | Investment grade municipal bonds are investments in bonds issued by municipalities—cities, states, counties—as well as enterprises that serve a public purpose, such as universities, hospitals and utilities. |

| Commodities | Description |

| Gold and Other Precious Metals | Precious metals include gold, silver, platinum, and other precious metals. |

| Cash | Description |

| FDIC-insured Cash | The FDIC-insured cash allocation in Schwab Intelligent Portfolios is invested in the Schwab Intelligent Portfolios Sweep Program, which is sponsored by Charles Schwab & Co., Inc. |

Asset class roles within the portfolio

To understand the rationale behind each asset class, it's helpful to group them according to their roles in the portfolio.

Growth potential will come primarily from the equity allocations (U.S. large-company, U.S. small-company, international developed country large-company, international developed country small-company and international emerging markets). These asset classes have historically delivered the highest returns, with a correspondingly higher risk. Most long-term investors should have at least some exposure to all of the major equity markets.

For investors focused on a more yield-oriented, or income-generating, portfolio, growth potential and income will come from dividend-paying stocks (U.S. and international). These securities offer the potential for both high returns and high yield.

Income will come from a broad array of fixed income investments, including U.S. investment grade corporate bonds, U.S. corporate high yield bonds, U.S. securitized bonds, international emerging market bonds, preferred stocks, bank loans and other floating-rate notes. Income generally accounts for the majority of a bond's total return; as such, bonds do not typically offer significant opportunities for growth. While bonds historically have provided higher levels of income, they carry varying degrees of risk.

Inflation protection comes from allocations to U.S. inflation protected bonds, and real estate investment trusts (REITs). With U.S. inflation protected bonds, the principal value adjusts upward with inflation. As U.S. inflation protected bonds have a constant coupon rate, this implies that the coupon, or interest received, grows with inflation.

Defensive assets are those that tend to perform well when there is downward pressure on equities (low or negative correlations with equities). Examples of defensive assets include Treasury securities, gold, international developed country bonds, and FDIC-insured cash.

Further detail and specifics on each asset class can be found in the Schwab Intelligent Portfolios Guide to Asset Classes & ETFs.

Market capitalization versus fundamentally weighted indices

Low-cost, index investing is traditionally based on what's known as market-capitalization weighted indices. This means that, all else equal, a stock portfolio that takes an index investing approach would be concentrated in the largest companies within an asset class. As an example, the largest 10 companies in the S&P 500® Index made up more than 25% of the entire index.1 It also means that, as the price of a security increases, so does its weighting, or proportion, of the portfolio. This can result in an overweight to the most overvalued companies and an underweight to the most undervalued companies (or at least those whose price has appreciated or depreciated, respectively). This is a contradiction to the "buy low, sell high" mantra. Though traditional market cap index investing is dirt cheap and remains a powerful way to invest in an asset class or market segment at a very low cost.

Over the past decade or so, "smart beta" or fundamentally weighted indices have gained in popularity as a low-cost alternative to traditional, market-capitalization weighted index investing. The weight of a company in a fundamentally weighted index is typically determined using metrics of intrinsic value other than price such as revenue, cash flow, or book value.

Based on research by Charles Schwab Investment Management Inc. and others, adding fundamental strategies in combination with market cap strategies can be beneficial to a portfolio over the long term. Schwab Intelligent Portfolios invests in both market capitalization and fundamentally weighted index products across all of its major equity asset classes (U.S. large company, U.S. small company, international large company, international small company, and emerging markets).

Schwab Intelligent Portfolios strategies

Global strategies

The Schwab Intelligent Portfolios global strategies are our flagship strategies, designed to offer broad and well-diversified exposure to domestic, international, and emerging market economies. Depending on your risk profile, you will be invested in a mix of stocks, fixed-income asset classes and cash based on your goal, time horizon and both willingness and capacity to take risk. While portfolios are generally diversified across stocks and bonds, more conservative portfolios put more emphasis on bonds while more aggressive portfolios put more emphasis on stocks. You may also have a small allocation to gold or other precious metals.

U.S.-focused strategies

We also offer strategies with less exposure to international and emerging market economies for those of you with a preference for more U.S.-domiciled investments. U.S.-focused portfolios also include a mix of stocks, fixed income, and cash based on your goal, time horizon and risk profile, but they emphasize domestic investments. While we believe that the U.S. isn't the only game in town, we understand the desire for a "home bias" and the familiarity with and preference for more developed economies (the domestic-focused strategies do not have any allocation to emerging markets). A portfolio concentrated in one geographical region may see higher volatility over time which is why most of our U.S.-focused portfolios maintain a small allocation to international developed large cap stocks.

Income-focused strategies

Schwab Intelligent Portfolios also offers strategies that are focused on investments that pay out a higher percentage of their earnings to investors in the form of interest or dividend payments. These strategies include more exposure to so-called "blue-chip" companies and also include higher yielding asset classes such as preferred stocks, bank loans and other short-term floating-rate notes. The income-focused strategies do not have any allocation to gold or other precious metals.

Municipal bond variations

For taxable accounts and investors in higher tax-brackets, we also offer versions of each of the strategies above with federally tax-exempt municipal bonds. Depending on the state you live in, bond interest may also be exempt from state income taxes. Municipal bonds typically pay out less interest than comparable fixed-income alternatives but, depending on your unique tax situation, can offer attractive after-tax returns. We swap out the fixed-income allocations to Treasuries, corporate bonds, and agency mortgage-backed securities for investment-grade municipal bonds. For Californians, we offer a version of our strategies concentrated in California-specific municipal debt.

Exhibit 4: Schwab Intelligent Portfolios asset classes based on strategies offered

| Stocks | Global | Global + Municipal Bonds | U.S. Focused | U.S. Focused + Municipal Bonds | Income Focused | Income Focused + Municipal Bonds |

| U.S. Large Company Stocks | ✓ | ✓ | ✓ | ✓ | ||

| U.S. Large Company Stocks–Fundamental | ✓ | ✓ | ✓ | ✓ | ||

| U.S. Small Company Stocks | ✓ | ✓ | ✓ | ✓ | ||

| U.S. Small Company Stocks–Fundamental | ✓ | ✓ | ✓ | ✓ | ||

| International Developed Large Company Stocks | ✓ | ✓ | ✓ | ✓ | ||

| International Developed Large Company Stocks-Fundamental | ✓ | ✓ | ✓ | ✓ | ||

| International Developed Small Company Stocks | ✓ | ✓ | ||||

| International Developed Small Company Stocks–Fundamental | ✓ | ✓ | ||||

| International Emerging Markets Stocks | ✓ | ✓ | ||||

| International Emerging Markets Stocks–Fundamental | ✓ | ✓ | ||||

| US Exchange-Traded REITs | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| International Exchange-Traded REITs | ✓ | ✓ | ✓ | ✓ | ||

| US High Dividend Stocks | ✓ | ✓ | ||||

| International High Dividend Stocks | ✓ | ✓ |

| Fixed Income | Global | Global + Municipal Bonds | U.S. Focused | U.S. Focused + Municipal Bonds | Income Focused | Income Focused + Municipal Bonds |

| U.S. Treasuries | ✓ | ✓ | ✓ | |||

| U.S. Investment Grade Corporate Bonds | ✓ | ✓ | ✓ | |||

| U.S. Securitized Bonds | ✓ | ✓ | ✓ | |||

| U.S. Inflation Protected Bonds | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| U.S. Corporate High Yield Bonds | ✓ | ✓ | ✓ | ✓ | ||

| International Developed Country Bonds | ✓ | ✓ | ✓ | ✓ | ||

| International Emerging Markets Bonds | ✓ | ✓ | ✓ | ✓ | ||

| Preferred Securities | ✓ | ✓ | ||||

| Bank Loans | ✓ | ✓ | ||||

| Investment Grade Municipal Bonds | ✓ | ✓ | ✓ |

| Commodities | Global | Global + Municipal Bonds | U.S. Focused | U.S. Focused + Municipal Bonds | Income Focused | Income Focused + Municipal Bonds |

| Gold and Other Precious Metals | ✓ | ✓ |

| Cash | Global | Global + Municipal Bonds | U.S. Focused | U.S. Focused + Municipal Bonds | Income Focused | Income Focused + Municipal Bonds |

| FDIC-insured Cash | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Conclusion

This paper provides an overview of the vast universe of expanded asset classes Schwab Intelligent Portfolios invests in, and the various investment strategies we offer depending on your unique preferences and situation. We believe in the power of diversification, and this is reflected in the way we create portfolios. See our follow-on paper on portfolio construction for a deeper-dive. For those interested, we also have a separate article that explains how we select the particular funds and ETF providers for every asset class.