When it's time to help turn retirement savings into retirement income.

We're here for you.

Making the shift from saving for retirement to spending in retirement is a big change. The good news? Schwab has the resources to help make this transition as seamless as possible.

An effective approach to managing income in retirement includes these four steps.

-

StepPlan your spending.

Create a financial plan based on your goals, expected spending, and how long you need your money to last.

-

StepChoose your investments.

Build a diversified portfolio that takes into account your desired growth, income, risk, and timeline.

-

StepTap your income sources.

Generate a reliable income stream by tapping your entire portfolio in tax-smart ways.

-

StepUpdate your plan.

Monitor and adjust your plan and portfolio regularly to help make sure your money lasts, regardless of life or market changes.

When choosing your investments, consider each of these key elements to help build a complete retirement income portfolio.

When choosing your investments, consider each of these key elements

Schwab has solutions to address all four steps for you.

Get retirement guidance from our financial professionals.

Get as much—or as little—help as you'd like from a financial professional—in person or on the phone.

- Wherever you are in your retirement journey, Schwab financial professionals can help you choose an appropriate level of advice and service based on your goals.

- They can connect you to specialists when you need help with more complex financial matters such as insurance, taxes, trusts, estates, or fixed income.

- They'll help you build and monitor your plan using our wide array of tools, from whole-portfolio solutions to separately managed accounts and specialty investment products.

An automated retirement income solution that does the work for you.

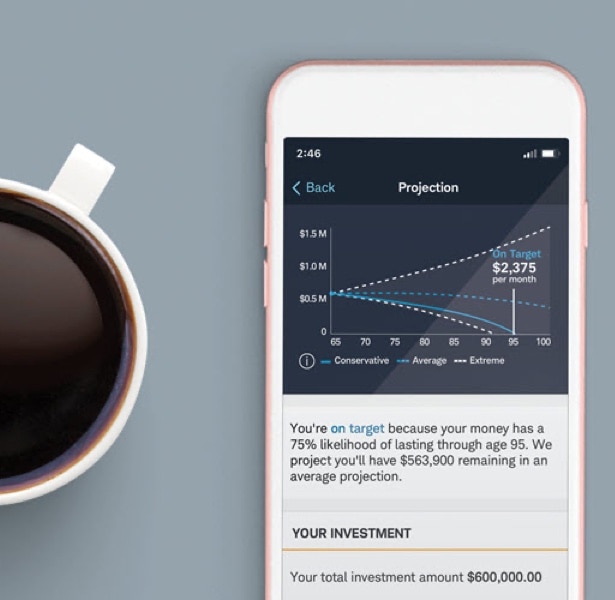

Schwab Intelligent Income™ is a simple, modern way to pay yourself in retirement by generating a predictable monthly paycheck from your investments. You’re eligible to enroll when you open a Schwab Intelligent Portfolios® account.

- Tell us how much you’ve saved and how long you need it to last.

- We’ll determine how much you can withdraw each month.

- We’ll build a diversified portfolio across your accounts, automatically rebalancing it and keeping you on track.

- We’ll manage making tax-smart withdrawals, including Required Minimum Distributions (RMDs).

For unlimited 1:1 guidance from a CERTIFIED FINANCIAL PLANNERTM professional, choose Schwab Intelligent Portfolios Premium®.

Have any questions?

-

Call

Call -

Chat

Chat -

Visit

Visit