Schwab Stock Slices. A simple, low-cost way to give the gift of ownership.

Why spend money on gifts like toys that will break or go out of style?

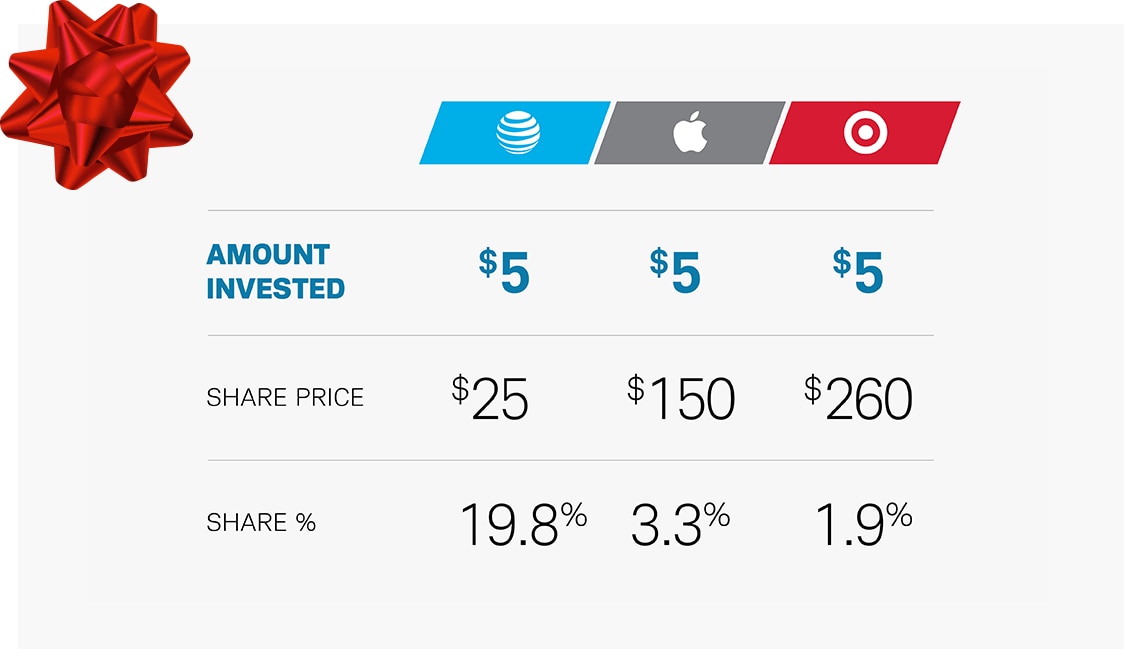

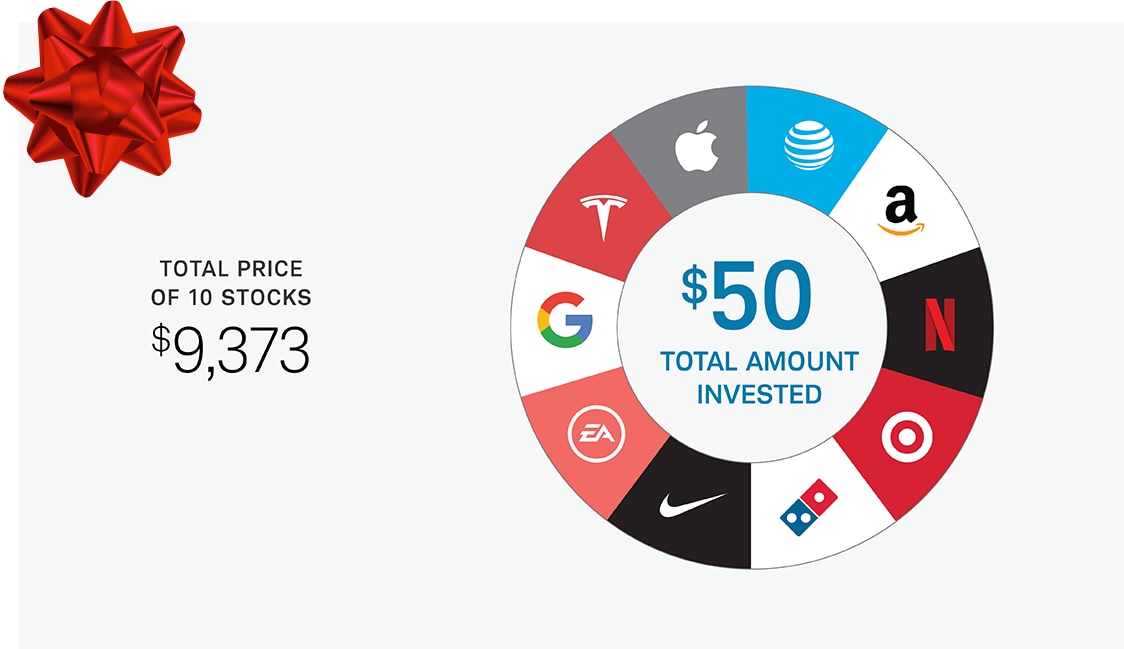

With Schwab Stock Slices™, you can introduce someone you care about to a gift they can appreciate over time. Once you have funded a custodial account, for as little as $5 you can purchase fractional shares in any of America’s leading companies in the S&P 500®. Whether it’s a gift for a birthday, holiday, or graduation, Schwab Stock Slices is a great way to teach Tooltip the power of investing.

-

Educational

It provides a way to teach investing to someone you care about. Visit Schwab Moneywise to learn more.

-

Engaging

It can be a fun and exciting way for people you care about to enter the world of investing.

It's easy to get started.

-

StepOpen a Custodial Account

If you already have a custodial account, you can buy stock slices now. If you don't have a custodial account, you will need the contact information, birth date, and SSN of the minor handy to get started. Read more about the Schwab One® Custodial Account.

-

StepFund Custodial Account

Once you open the custodial account, it may take a few days for it to be approved and funded. You’ll be notified when your funds are available.

Give the gift of ownership.

-

Give the gift of ownership.

Already have a custodial account? Log in.

Interested in buying fractional shares for yourself?

Interested in buying stock slices for yourself?

Already a Schwab client? Log in to your brokerage account to buy stock slices.

Happy to answer any questions.

-

Schwab Stock Slices is an easy way to buy fractional shares (or whole shares) for a set dollar amount. You have the option to buy slices of stock in up to 30 top U.S. companies in a single transaction. The shares you purchase through Schwab Stock Slices can be held and sold independently.

-

A fractional share (stock slice) is when you own less than one whole share of a company. Fractional shares allow you to invest in stocks based on a dollar amount, so you may end up with a fraction of a share, a whole share, or more than one share.

-

Great question. A custodial account is an account that’s set up and managed by an adult on behalf of a young person who’s legally a minor. A minor is typically someone who’s younger than 18 or 21, depending on the state. While the adult custodian controls the account, the assets in the account are the property of the minor. Once the minor reaches the "age of majority" (legal adult age in their state), they will take control of the assets in the account. Learn more about the potential benefits and limitations of a custodial account.

-

You can open and fund a custodial account online. In addition to information about yourself, you'll need the minor's contact details, birth date, and Social Security number. Note that trading in the account can only occur once the custodial account is open and funded. Learn more and open a custodial account.

-

You can invest in fractional shares in any company in S&P 500 index, which covers the 500 leading large-cap U.S. publicly traded companies, through Schwab Stock Slices. The S&P 500 is often used as a benchmark or indicator of how large-cap U.S. equities are performing. See a list of companies in the S&P 500 Index.

-

Yes, the minimum for a single transaction is $5, and the maximum is $50,000.

-

No. You can use Schwab Stock Slices to invest as often as you want.

-

The fractional share(s) will be in your brokerage account.

-

Yes, to place a Schwab Stock Slices order, you will need to have an eligible Schwab brokerage account (e.g., custodial, individual, joint account, etc.).

-

There are no commissions when you place a trade online through Schwab Stock Slices.

-

If you use Schwab Stock Slices to buy shares through a custodial account, you can print and personalize an announcement of your purchase. See an example of an announcement.

-

Multiply your current fractions by the whole number shares of the stock split to see what your future whole or fractional share holdings will be upon completion of the stock split. For example, if you owned .15 of a share and the company announced a split of three additional shares, you could anticipate holding .45 (.15 * 3) of a share when the stock split is complete. If you held .43 shares of the same company, at the completion of the stock split you'd have 1.72 shares. This equates to a whole share and a fractional share because the split would award you an additional 1.29 shares (.43 x 3) shares.

Have more questions? We're here to help.

-

Call

Call -

Chat

Chat -

Visit

Visit