Leverage is a way of using a relatively small amount of capital to trade a large position. This principle applies to the futures1 market in the form of margin2 trading, which offers the potential to establish a position in a commodity—such as crude oil or corn—or some other asset with a relatively small amount of money. But with that leverage comes risks, including the margin call.3

Futures margin allows traders to pay less than the full "notional" value of a trade, potentially offering more efficient use of capital or opportunities to hedge against adverse market swings. Futures margin is leverage that can potentially enhance returns. However, leverage can also quickly exacerbate losses with small price movements. When using margin for futures trading, it's important to understand risk and consider that futures trading isn't appropriate for everyone.

Futures margin vs. margin on stocks

Margin trading in the equity market means borrowing money from a broker to purchase stock. In the futures market, a trader puts down a good-faith deposit called the initial margin requirement or "performance bond." This ensures each party (buyer and seller) can meet their obligations as spelled out in the futures contract.

Initial margin requirements vary by futures product and are typically a small percentage—from 2% to 12%—of the contract's notional value (the cash equivalent value to owning the asset, or the total value of the contract). In equity margin trading, by contrast, an investor can borrow only up to 50% of the purchase price or total value of the trade (based on the Federal Reserve's Regulation T, or "Reg T," rule).

Maintenance margin vs. initial margin

A certain amount of money must always be maintained on deposit with a futures broker. Traders establishing a new futures position must put up the initial margin requirement. However, once the position is established, the trader is held to the maintenance margin requirement. If the equity in a trader's account drops below the maintenance margin requirement due to adverse price movement, the broker will issue a "margin call" to restore the client's equity to the initial margin requirement.

An individual or retail investor who wants to trade futures must typically open an account with a futures commission merchant (FCM) and post the initial margin requirement, which in turn is held at the exchange's clearinghouse. Different futures exchanges specify initial margin and maintenance margin levels for each futures contract, but FCMs may require investors to post margin at higher levels than those specified by the exchange.

How futures margin works: Crude oil example

Futures can be used to gain exposure to a specific asset class and speculate on price movement of individual futures products, such as gold or crude oil, or equity benchmarks, such as the S&P 500® index (SPX). For example, CME Group's "micro" futures contracts (based on oil), the SPX, and other markets are among the potential avenues for individuals who want to use less margin (although the some inherent risks apply).

Micro WTI Crude Oil (/MCL) futures are one-tenth the size of CME’s standard WTI Crude Oil (/CL) futures contract and represent 100 barrels of West Texas Intermediate grade crude, the U.S. benchmark. This means the micro contract's margin requirement is also one-tenth of its larger counterpart. For example, let's say the maintenance margin requirement for one standard /CL futures contract is $5,100, and the margin requirement for a /MCL futures contract is $510 (a little more than 7% of the contract's notional value).

If a trader expects crude oil prices to move higher, they might buy five /MCL contracts at $65 per barrel, putting up at least $2,550 in initial margin (good faith deposit) to establish a position in a futures contract with a notional value of $32,500. If oil rises to $66, the notional value of the futures position would gain $500 ($1 x 100 barrels x 5 contracts) to $33,000. If the trader sold those five contracts at $66, they'd pocket the $500 gain.

But if the price of oil falls, this same leverage would work against the trader, magnifying the loss.

What happens in a futures margin call?

Margin calls are triggered when the value of an account drops below the maintenance level, prompting the broker or FCM to require additional money to be deposited.

Using the previous oil futures example, a drop in crude prices to $64 would reduce the five contracts' notional value by $500. If the futures account balance fell below the $2,550 maintenance margin, the broker would require an immediate deposit of additional funds to bring the account back up to the initial margin requirement.

Futures trading is not for everyone, and as with stocks, margin can lead to losses as well as potential gains. Because margin requirements for futures contracts involve leverage, profits and losses can be magnified, so it's possible to lose more than the initial investment to open a futures position. If a margin call is not met within a short time frame—often within a single business day—the position may be liquidated or closed.

What is an "intraday" margin call?

There's a perception that margin calls happen after the trading day ends and markets are closed, but that's not always the case. Under certain circumstances, a broker may require more funds from its clients while markets are still open. This is called an intraday margin call.

Although margin calls are typically issued based on the market close, if a client's positions are at risk of overexposure or extreme losses during the trading day, the broker may try to contact clients to make them aware and request additional funds if needed. It's important for traders to remember, however, that they as the account holder are ultimately responsible for monitoring their account and being aware of any low equity situations and any extreme volatility that might be occurring.

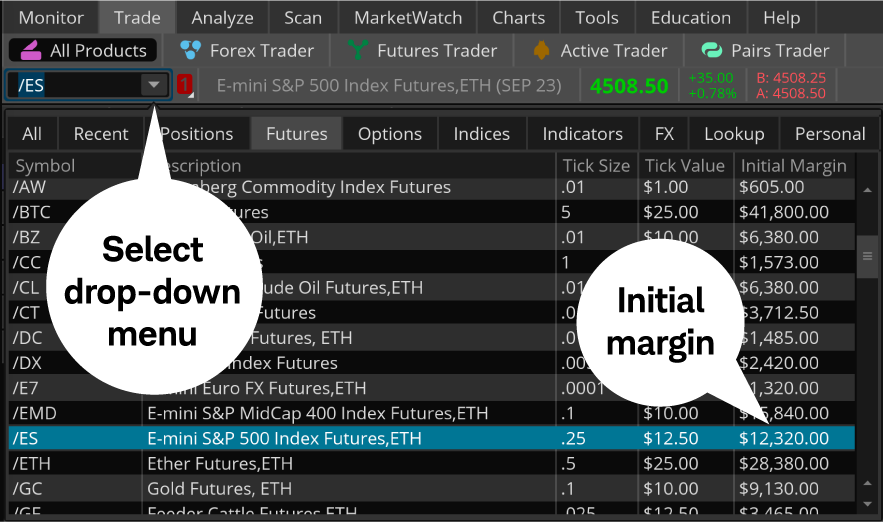

Finding initial margin on thinkorswim®

To view initial margin, tick size, and other futures contract information on the thinkorswim platform, select Futures from the drop-down menu on the Trade tab (see below).

Source: thinkorswim platform

For illustrative purposes only. Past performance does not guarantee future results.

Qualified Schwab account owners can apply online to trade futures products.

1 A futures contract is an agreement to buy or sell a predetermined amount of a commodity or financial instrument at a certain price on a stipulated date.

2 The buyer or seller of a futures contract is required to deposit part of the total value of the specified commodity future that is bought or sold—this is known as margin money.

3 A margin call is issued when an account value drops below the maintenance requirements due to a drop in the market value of an account's holding or holdings or when buying power is reduced. Margin calls may be met by depositing funds or selling stock. A broker may forcibly liquidate all or part of an account without prior notice, regardless of intent to satisfy a margin call, in the interests of both parties.

Futures and futures options trading involves substantial risk and is not suitable for all investors. Please read the Risk Disclosure Statement for Futures and Options prior to trading futures products.

Futures accounts are not protected by the Securities Investor Protection Corporation (SIPC).

Additional CFTC and NFA futures and forex public disclosures for Charles Schwab Futures and Forex LLC can be found here.

Futures and futures options trading services provided by Charles Schwab Futures and Forex LLC. Trading privileges subject to review and approval. Not all clients will qualify.

Charles Schwab Futures and Forex LLC is a CFTC-registered Futures Commission Merchant and NFA Forex Dealer Member.

Charles Schwab Futures and Forex LLC (NFA Member) and Charles Schwab & Co., Inc. (Member SIPC) are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation.

The S&P 500® is a product of S&P Dow Jones Indices LLC or its affiliates ("SPDJI") and has been licensed for use by Charles Schwab & Co., Inc. Standard & Poor's® and S&P® are registered trademarks of Standard & Poor's Financial Services LLC ("S&P"); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"). Charles Schwab & Co., Inc is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500.

The information here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The type of securities and investment strategies mentioned may not be suitable for everyone. Each investor needs to review a security transaction for his or her own particular situation. Data here is obtained from what are considered reliable sources; however, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

0923-3DHA