Schwab Intelligent Income: A Simple, Modern Way to Pay Yourself from Your Portfolio

Key Points

- When it comes to retirement income needs, it can be complex and time consuming to figure out how much you can withdraw from your investment accounts and how long your money will last.

- That's why we created Schwab Intelligent Income®, which is available with Schwab Intelligent Portfolios® Solutions and is designed to automate Schwab's best thinking on retirement income and generate a monthly paycheck from your portfolio.

- Schwab Intelligent Income projects how much you can afford to withdraw from multiple enrolled accounts and generates recurring tax-smart withdrawals that you can start, stop, or adjust at any time without penalty.

Introduction

You've spent a lifetime working and saving for retirement. You've made big plans, and now you finally have the time to fulfill those dreams—but how will you know if you have enough savings? Whatever your dreams are, after a lifetime of saving, you've earned the right to enjoy your retirement—and that's a lot easier to do when you have the confidence that your savings will last for the long haul.

But creating a steady income stream can be complex and time consuming because it requires you to figure out how much you can withdraw from your investment accounts, which accounts to withdraw from, and how to facilitate the withdrawals to get the money when you need it. Many investors simply default to an interest-and-dividends-only approach because that's what they're most familiar with. For some, that might be enough. But for many, it means cutting spending because they're wary of withdrawing the money they really need. In fact, research shows that most investors spend far less than they could in retirement, with the typical retiree still holding 80% of their savings after 20 years in retirement.1

At the same time, Americans are living longer but few have traditional pensions, factors that increasingly require investors to augment Social Security with distributions from their portfolios. Investors are looking for a solution that can help them navigate these complexities efficiently. That's why we created Schwab Intelligent Income.

What is Schwab Intelligent Income?

Schwab Intelligent Income is a new feature available with Schwab Intelligent Portfolios Solutions that projects how much you can afford to withdraw from your portfolio each month, generates recurring tax-smart withdrawals, and deposits the money into an account of your choice. The feature offers a simple, efficient, and automated way to schedule and monitor withdrawals across enrolled taxable accounts and IRAs to help meet your income needs, while allowing you to feel confident that your hard-earned savings will remain on track to last through retirement.

Schwab Intelligent Income is designed to provide:

- Predictable paychecks: In a matter of minutes, you're able to gain clarity on how much you can regularly withdraw from your enrolled accounts to help meet your income needs.

- Tax-smart withdrawals: Generating withdrawals from your portfolio in a tax-smart way is a complex process that needs to consider Required Minimum Distributions (RMDs), the order of distributions from different account types, and tax-loss harvesting logic for taxable accounts. Schwab Intelligent Income handles the complexity for you by using algorithms that generate tax-smart withdrawals across all enrolled accounts.

- Flexibility and control: An online dashboard allows you to efficiently monitor your progress and easily start, stop, or adjust withdrawals at any time—and allows you to experiment with different scenarios if you want to make changes to your withdrawals.

Enrolling in Schwab Intelligent Income is easy. All you need is information about the accounts you want to enroll, the amount in each account, and how long you want the withdrawals to last. We'll estimate how much you can withdraw each month, or you can tell us your desired amount, and we'll give you a sense of how long it could last. Schwab Intelligent Income can be used as the primary source for your income needs or as a way to supplement other income sources, such as Social Security, pensions, annuities, and rental income.

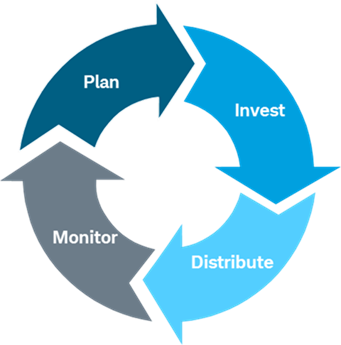

Automating the key steps for retirement income

Generating the necessary distributions to meet your retirement income needs can be complex, and investors are often uncertain where to begin. We're here to help. Schwab Intelligent Income is designed to automate Schwab's best thinking on retirement income by helping you answer four key questions:

- Plan: How much can I afford to withdraw?

Determining how much you can afford to withdraw from your investment accounts is one of the most daunting aspects of retirement. When you answer a few questions about your savings, withdrawal goals, and risk profile, Schwab Intelligent Income projects how much you can regularly withdraw from your enrolled accounts and still feel confident that your money could last through retirement. It does this by estimating how long your money could last under different market conditions. And it gives you control so you can make adjustments, without penalty, if your needs or situation change. - Invest: How should I invest?

Many investors are overwhelmed by the choices they face as they begin thinking about investing. Schwab Intelligent Income uses low-cost ETFs to build a portfolio that is based on your risk profile. Your portfolio is diversified, with up to 20 asset classes across stocks, bonds, commodities, and cash; is rebalanced automatically; and offers tax-loss harvesting for taxable accounts of at least $50,000. - Distribute: How can I get the money when I need it?

Getting your money is simple. You tell us how much you want to withdraw each month or each year, and Schwab Intelligent Income figures out which accounts to withdraw from and automatically sends you the money. Schwab Intelligent Income's tax-smart withdrawal strategy automatically takes recurring withdrawals from your enrolled taxable accounts and IRAs. And it automatically deposits the money into the account you designate—whether a Schwab or non-Schwab account—at whatever frequency is right for you. - Monitor: How will I monitor and adjust my portfolio?

We realize that life is constantly changing. You may feel the need to make changes to your withdrawal strategy. And when market conditions change, you'll want to stay updated. You can log in anytime to make sure your money is still on track to last and to make any adjustments you feel are necessary. You can change, pause, or stop your withdrawals at any time, with no penalty. And we'll send you an alert if your strategy drifts off target or is at risk of not meeting your goal, and you can easily take action to get back on target. You can also unenroll from Schwab Intelligent Income at any time, without penalty.

Schwab Intelligent Income: A pathway through retirement

"We know what we are but know not what we may be." — William Shakespeare

When Charles and Shirley Dunham began spending more and more of their evenings talking about the possibility of retiring, they knew they were starting from a decent place. They'd worked hard and saved diligently for decades. However, they were uncertain about whether their savings could support the lifestyle they'd worked so hard to build and could pay for all the dreams that animated those evening discussions. Their excitement about finally having the time to pursue their dreams was tempered by uncertainty and even a bit of anxiety.

Shirley loved her work as a hospital administrator but was looking forward to spending more time in her garden and visiting their daughter, Angelique, and their twin grandkids in Arizona. Charles had worked hard in his career as an electrical engineer and was ready to finally have time to finish restoring the 1957 Thunderbird he'd been tinkering with in the garage for years. They enjoyed traveling, and after nearly 40 years of marriage, they looked forward to returning to Italy and to finally fulfilling Shirley's dream of visiting New Zealand. They also wanted to be able to donate to their alma mater, Ohio State; their church; and other charities.

The Dunhams had built up several retirement accounts, but they just didn't know how much they could withdraw from those accounts each year and still feel confident that their savings would last through 25 to 30 years of retirement. And they were unsure about how to manage and withdraw the funds they would need.

The challenge

The Dunhams had $700,000 in total retirement savings. That included Charles's 401(k) and Shirley's 403(b), which they planned to roll over into IRAs. Charles also had a taxable brokerage account, and Shirley had a Roth IRA. Based on their budget, they estimated that they would need about $60,000 per year, or $5,000 per month, pre-tax to cover basic living expenses and the other activities they hoped to pursue.

Social Security would provide a total of $29,000 per year between the two of them, with Charles receiving $1,250 per month and Shirley receiving $1,167 per month. But that would cover only about half of their total income needs. They would need an additional $31,000 per year from their investment accounts. They also knew they would need to begin taking RMDs from their new rollover IRAs in a few years. But they weren't sure which investment accounts to withdraw from or how much they could afford to withdraw each month and still be sure they were staying on track for their savings to last through retirement.

Table 1

- Client Profile

-

Client ProfileAge of married couple65

-

Client ProfileGoalSustained income for life

-

Client ProfileLongevityPlan to age 95

(30 years of retirement)

Table 2

Investment accounts: $700,000 total savings- Investment accounts: $700,000 total savings

-

Investment accounts: $700,000 total savingsCharlesShirley

-

Investment accounts: $700,000 total savings401(k) $250,000403(b) $200,000

-

Investment accounts: $700,000 total savingsTaxable account $100,000Roth IRA $150,000

Table 3

Retirement income needs: $60,000/year; $5,000/month- Retirement income needs: $60,000/year; $5,000/month

-

Retirement income needs: $60,000/year; $5,000/monthCharles $30,000Shirley $30,000

-

Retirement income needs: $60,000/year; $5,000/monthSocial Security

$15,000/year

$1,250/monthSocial Security

$14,000/year

$1,167/month-

Retirement income needs: $60,000/year; $5,000/monthFrom investment accounts

$15,000/year

$1,250/monthFrom investment accounts

$16,000/year

$1,333/month

For illustrative purposes only

The solution

The Dunham's financial consultant presented several potential solutions, and the couple decided to explore the Schwab Intelligent Income feature of Schwab Intelligent Portfolios, using the four key questions listed above.

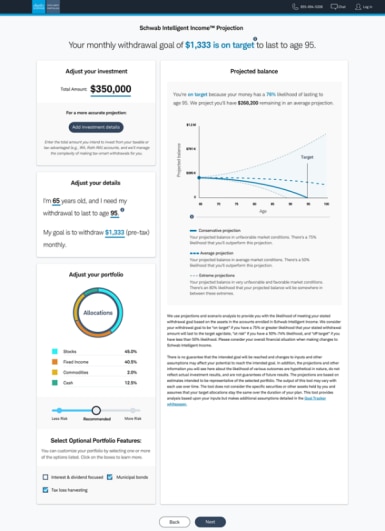

- How much can we afford to withdraw? Charles and Shirley learned that Schwab Intelligent Income would provide a user-friendly online tool. After they rolled over their 401(k) and 403(b) accounts into IRAs within Schwab Intelligent Portfolios, they could each separately enroll their accounts into Schwab Intelligent Income. Charles could take the $1,250 he needed per month from his enrolled accounts, while Shirley could separately take the $1,333 per month she needed from her enrolled accounts. They have the option to increase their withdrawal amount annually, as needed, to keep up with inflation and rising living costs.

Charles and Shirley would need to enroll in Schwab Intelligent Income separately, but the solution showed that the total annual withdrawals each would make would put them on target for the $350,000 portion of their total savings to last 30 years. And it projected that, after those 30 years, they would still have a combined total of $635,700 ($367,500 for Charles, $268,200 for Shirley) remaining, assuming an average market environment for their risk profile. So their funds could provide the income they need now as well as money for unexpected future events or to leave to their heirs. Of course, the market environment might be stronger or weaker than average over their withdrawal period, resulting in a higher or lower value at the end of the 30-year period.

For illustrative purposes only

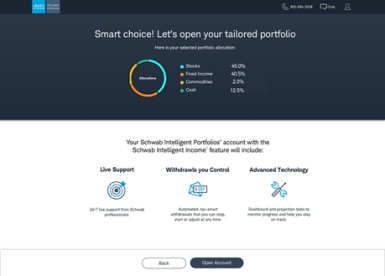

- How should we invest? The program gave each of them an investment recommendation for a diversified portfolio of ETFs based on their age, time horizon, and moderate risk profile, a portfolio that would consist of 45% stocks, 40.5% fixed income, 2% commodities, and 12.5% cash. And each one's portfolio would be professionally managed, including automated rebalancing to keep the allocation consistent over time and tax-loss harvesting for the taxable brokerage account.

For illustrative purposes only

- How can we get the money when we need it? They learned that the program takes a tax-smart approach and would spread withdrawals across their accounts while turning those withdrawals into the monthly paycheck from their portfolio that they would need. Charles's $1,250 monthly paycheck would be generated by withdrawing $893 from his rollover 401(k) and $357 from his taxable account. For Shirley, her entire monthly paycheck of $1,333 would come from her rollover 403(b), allowing her Roth IRA to continue to benefit from tax-free growth. These amounts could vary over time, based on the relative performance of their accounts and in order to accommodate RMDs in future years. The automatic withdrawals combined with the money each would receive from Social Security would meet their total expected monthly need of $5,000. Shirley and Charles were thrilled with how easy it would be to automate the whole process—there would be no need for them to personally manage the investments, facilitate the distributions by selling assets, or manually transfer funds.

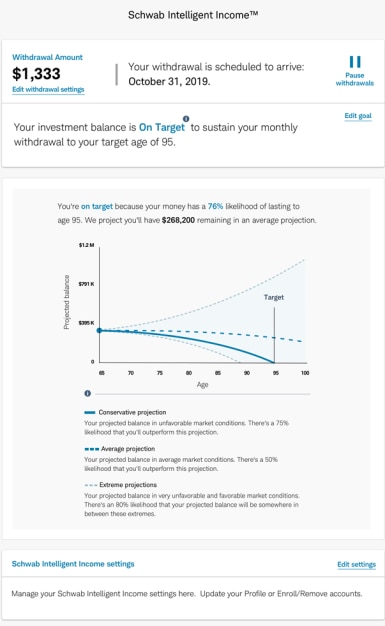

- How will we monitor and adjust our portfolios? Charles and Shirley learned that each would have online access to their own individual dashboard for their accounts. There, they could easily track their progress over time to help ensure that each was staying on track, and they would have the ability to easily make any adjustments that might be needed. The Dunhams were happy that they would have the ability to log in to their accounts anytime to see if their money was on target to last through to their target date. They appreciated that if they were at risk of missing their goal, they would get proactive alerts and recommendations for how to get back on target and that they would have the ability to run simulations projecting the effects of the changes before having to make them.

For illustrative purposes only

The results

Learning about Schwab Intelligent Income gave Charles and Shirley the insight and confidence they needed to make a choice that would allow them to celebrate their successful careers and begin to enjoy their hard-earned retirement. After enrolling in Schwab Intelligent Income and receiving its straightforward guidance, the Dunhams were able to overcome their uncertainties and take the steps necessary to fulfill their dreams and enjoy the travel and the time with their family that they'd long looked forward to.

Schwab Intelligent Income: How it works

Recognizing the complexities that investors face when it comes to retirement income needs, we've designed Schwab Intelligent Income to help make it easy for you to address those challenges. Schwab Intelligent Income automatically coordinates withdrawals from your various taxable, tax-deferred, and tax-exempt accounts while taking advantage of multiple sources of income, including:

- Cash

- Interest

- Dividends

- Investment growth

- Original investment

Schwab Intelligent Income looks at enrolled taxable accounts, traditional IRAs and Roth IRAs to determine which accounts to use first for your recurring withdrawals. In doing so, it considers ways to increase tax efficiency and maximize how long your savings will last. As with all Schwab Intelligent Portfolios accounts, interest and dividend payments accumulate in the account as cash, until the cash allocation exceeds its targeted proportion of the portfolio by enough to trigger a rebalancing. (Please see the Tax-Loss Harvesting & Rebalancing white paper for more information on the rebalancing methodology.) If the amount of cash in your account ahead of your scheduled withdrawal is insufficient to meet your withdrawal request, additional sources of income can come from growth in your investments and from your original investment. In this case, shares of the ETFs in your account that are most overweight at that point in time compared with their targeted proportion of your portfolio will be sold in a tax-efficient manner until the level of cash in your account is enough to meet your withdrawal request. Once the amount of cash in your account is sufficient to meet your withdrawal request, the cash will be transferred on its scheduled date to the account in which you have chosen to receive your withdrawals.

Assessing your risk profile and withdrawal amount

Using your answers to a few simple questions about your market experience and how you react to market volatility, Schwab Intelligent Income will assess your risk profile and will recommend a portfolio that has a level of risk consistent with your needs and your willingness and capacity to take risk.

After completing the short risk profile questionnaire, you'll answer a few questions about your withdrawal needs, such as:

- How much money are you planning to enroll?

- How long will the withdrawals need to last?

Based on your answers to these questions and other information you provide, Schwab Intelligent Income will calculate and suggest a personalized monthly withdrawal amount. Schwab Intelligent Income runs simulations to project, with varying probabilities, how your portfolio might perform under various market conditions.

Assessing your withdrawal amount

When it comes to developing a plan for taking disciplined withdrawals from your investment accounts to support your spending needs in retirement, one important unknown is how long the money will need to last. No one knows with certainty how long they'll live, but Schwab suggests planning for a life expectancy of 93. Schwab Intelligent Income calculates and recommends a pre-tax withdrawal amount that it has determined has approximately an 80% probability of being sustainable—including planning for annual increases to keep pace with inflation—through the time frame you specify. To arrive at this figure, Schwab Intelligent Income runs your portfolio through simulations of 1,000 different hypothetical future market environments and paths of investment returns.

We believe this is a good place to start. However, you have a range of choices. At one end of the spectrum, you can choose to spend very little or nothing at all and have a very high probability that your portfolio will last longer. At the other end, you can spend more, drawing down your investments more quickly and potentially running out of money too soon. For some, an 80% probability that their money will last might seem too low. Why not higher? Schwab Intelligent Income seeks to balance your desire to spend your money and to enjoy retirement now with helping you stay on track and making sure your savings last. The choice is yours. Schwab Intelligent Income is designed to help you make a choice and stay on track—but also to have the flexibility to change your mind and make adjustments along the way.

In order for you to enroll, Schwab Intelligent Income requires establishing a withdrawal level that will allow for at least a 75% likelihood that your money will last. So we recommend you begin withdrawing at a rate that gives a better-than-average chance your money will last. This approach is designed to help you feel comfortable spending at a certain level now while feeling confident that there is a high potential your money will last, even in a weak market environment or if you live longer than expected. At times when there is an average or better market environment, if your spending rate is in the range we suggest, you might see some decline or even some growth in your account value, especially early in retirement. But this of course depends on how markets perform. And Schwab believes that when it comes to something as important as your retirement, it isn't good planning to assume the market will be "average."

Taking a tax-smart approach

Schwab Intelligent Income uses a tax-smart withdrawal strategy that prioritizes the order of withdrawals across different account types in order to help smooth out and reduce your tax burden and potentially increase what you keep after taxes throughout retirement. Schwab Intelligent Income will execute the trades and automatically distribute the funds from each of your accounts into a single account at the frequency you select during enrollment.

If you have multiple accounts and account types enrolled, Schwab Intelligent Income takes withdrawals from across the accounts in the following order (for more information regarding our withdrawal strategy, see the paper "Schwab Intelligent Income: A tax-smart withdrawal strategy"):

- First: Prioritize, if known, Required Minimum Distributions (RMDs) across tax-deferred retirement accounts for clients who reach age 73 in 2023 or later as a result of the SECURE Act 2.0 signed into law at the beginning of 2023.

- Failure to take RMDs could result in a 50% tax penalty, so it's important to make sure RMDs are accounted for properly.

- Second: Draw proportionally from taxable and tax-deferred accounts.

- We also draw from tax-deferred accounts in an effort to help reduce future RMDs that could trigger a jump in future tax rates.

- When selling securities to meet withdrawal needs and as part of regular rebalancing for your investment accounts, Schwab Intelligent Income uses a tax-efficient sell order that prioritizes sales of assets with long-term capital gains over those with short-term gains.

- Third: Withdraw from Roth IRAs.

- Drawing from Roth IRAs last prolongs the benefit of tax-free growth and saves Roth assets for large, unexpected expenses because those funds can be withdrawn tax-free.

Monitoring your progress

Your dashboard will be your one-stop location for managing withdrawals within Schwab Intelligent Income on an ongoing basis. The dashboard provides an up-to-date analysis that shows you how you're tracking against your plan and allows you to review your individual accounts or your portfolio. You can change, pause, or stop your withdrawals at any time, without penalty, and can view both your history and when your next withdrawal is scheduled for distribution.

In addition to the information it provides through the dashboard, Schwab Intelligent Income will send you an alert anytime you are at risk of missing your goal or are drifting off track from it and will provide you with some simple recommendations to get back on track.

Schwab Intelligent Portfolios Premium

As always, a Schwab representative is available to discuss not only Schwab Intelligent Income implementation but also how this feature can align with your overall planning and portfolio needs. If during the process you feel that you need to develop a more comprehensive financial plan, Schwab Intelligent Portfolios Premium might be a good choice for you.

Schwab Intelligent Portfolios Premium provides ongoing access to a CERTIFIED FINANCIAL PLANNER™ professional for a one-time $300 planning fee and a $30 per month advisory fee after that. During an initial meeting, a CFP® professional can help you develop a comprehensive financial plan across all of your assets and income streams. You'll also enjoy unlimited access to a sophisticated interactive online planning tool and CERTIFIED FINANCIAL PLANNER™ ; professionals on an ongoing basis to review your plan, explore additional financial planning needs such as estate planning or insurance needs, and make any updates as conditions change.

Conclusion

At Charles Schwab & Co., Inc., we understand that after you've spent so many years saving and investing for your retirement, it can be a complex process to figure out how to generate retirement income that lasts. Having the income you need for a comfortable retirement starts with knowledge and planning. That's why we've developed Schwab Intelligent Income as a new feature within Schwab Intelligent Portfolios Solutions.

With Schwab Intelligent Income, you have access to a simple online solution designed to do the work for you. The feature provides guidance to help you figure out how to invest and how to generate a regular paycheck from your investment accounts to meet your income needs. It will help you feel confident that your hard-earned savings are on track to last so that you can focus on enjoying your retirement.